Global Plant Based Protein Market Size and Overview

Plant Based Protein Market Outlook

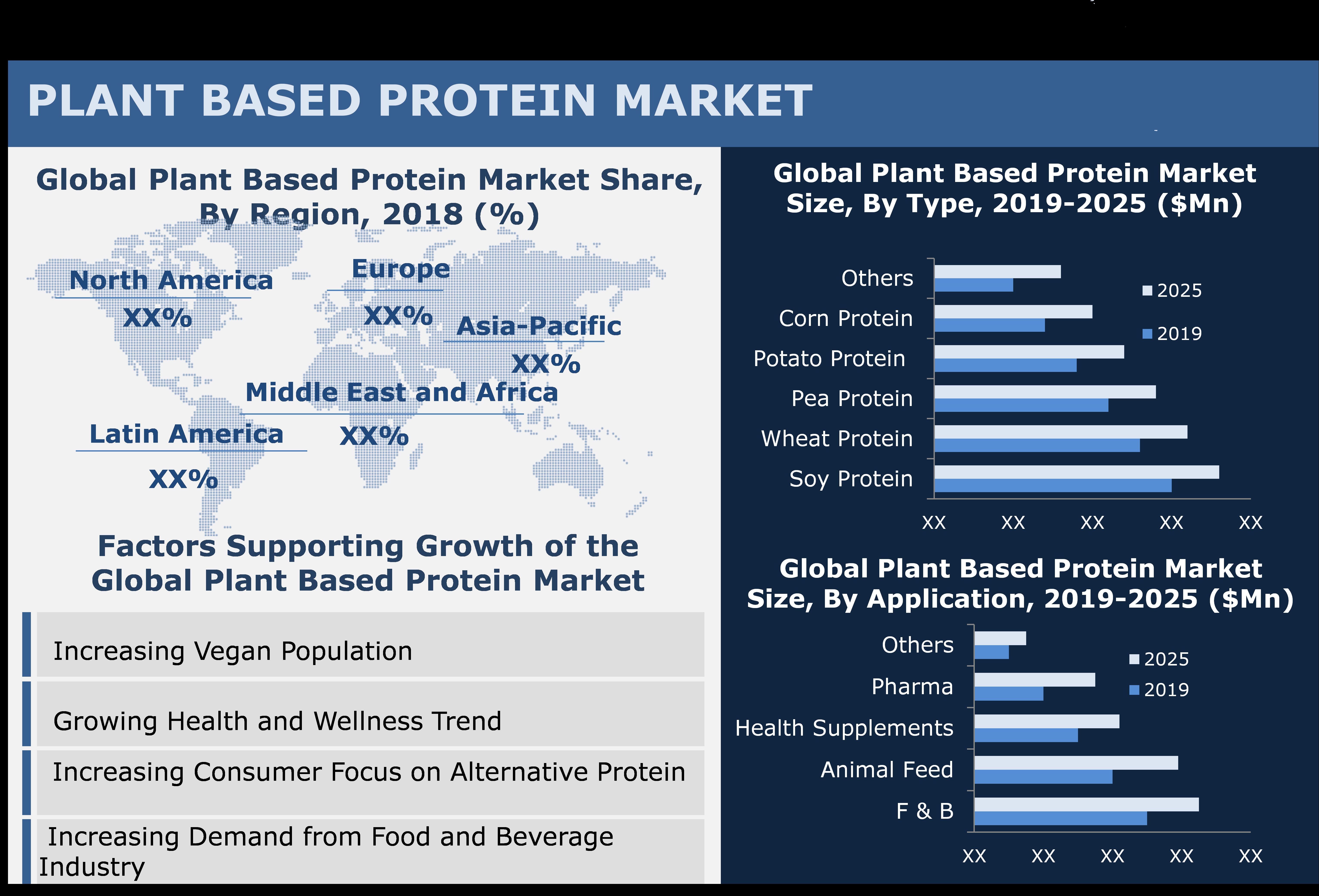

Consumer interest in boosting protein intake is increasing with more attention being paid to the specific types of protein being consumed. The desire for clean labels, ease of digestion, the need or desire to avoid allergens, compatibility with vegetarian and vegan lifestyles and concerns about sustainability among the general population are putting the spotlight on plant proteins. Consumer notions of what constitutes a good protein source are expanding to include a wider variety of plant protein ingredients. Subsequently, interest in plant protein ingredients among food manufacturers and food service operators is intensifying, fueling the growth of global plant based protein market. The global plant based protein market size was $7,256.8 million in 2018, and is projected to reach $15,418.9 million by 2025, growing at a CAGR of 9.4% from 2019 to 2025.

Plant Based Protein Market Snapshot

plant_based_market

Market Dynamics

Increasing vegan population, growing health and wellness trend, increasing consumer focus on alternative protein, and increasing demand from food and beverage industry have fueled the growth of the global plant based protein market. Conversely, significant preference for animal based food and unstable raw material prices has hindered the growth of this market to some extent.

Segment Overview:

Type Segment Overview

On the basis of type, soy protein segment accounted for the major share of the global plant based protein market in 2018. The large share of this segment mainly attributed to the easy availability, low cost than other sources of protein, increased demand from meat analogue manufacturers, wide range of applications in various products, and increased consumer awareness. However, pea protein market is expected to witness a rapid growth during the forecast period.

Application Segment Overview

On the basis of application, food and beverage segment held the largest share of the global plant based protein market in 2018. The large share of this segment is mainly attributed to increasing consumer preference for plant based foods and ingredients, growing awareness and demand for protein rich food products, versatile functionality, compatibility with vegetarian and vegan lifestyles, and rising clean label trend.

Geographic Overview

On the basis of geography, the plant based protein market analysis is conducted across North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa. North America held the major share in global plant based protein market in 2018, and is expected to remain dominant throughout the forecast period. The huge share of this market is attributed to well established food and beverage processing sector, rising concerns over animal products and protein, and increasing vegan population. However, Asia-Pacific is expected to grow at the fastest CAGR during the forecast period. The fastest growth of this region primarily attributed to large base of vegan population, expanding food and beverage manufacturing sector, increasing health consciousness, and increasing economy.

Competitive Landscape

The global plant based protein powder market is a moderately consolidated in nature. To enlargement of market presence key ma players’ mainly focus on strategies such as new product launches, mergers, acquisitions, and collaborations. Key players include in plant based protein market are Cargill, Incorporated, Archer Daniels Midland Company, Ingredion Incorporated, Roquette Frères Le Romain, Kerry Group, E.I. Dupont De Nemours And Company, Tate & Lyle Plc, Axiom Foods, Glanbia Plc, and Beneo GmbH.

Plant based protein Market Segments:

Plant based protein Market by Type

Soy Protein

Wheat Protein

Pea Protein

Potato Protein

Corn Protein

Others

Plant based protein Market by Application

Food and Beverages

Animal Feed

Nutrition and Health Supplements

Pharmaceutical

Others

Plant based protein Market by Geography

North America

U.S.

Canada

Europe

Germany

France

U.K.

Italy

Spain

Rest of Europe

Asia-Pacific

China

Japan

India

Rest of Asia Pacific

Latin America

Middle East & Africa

TABLE OF CONTENT

1. Introduction

1.1. Market Definition

1.2. Purpose of the Report

1.3. Currency

1.4. Limitations

1.5. Stakeholders

2. Research Methodology

2.1. Research Scope

2.2. Market Segmentation

2.3. Research Approach

2.3.1. Top-Down Approach

2.3.2. Bottom-Up Approach

2.4. Primary Research

2.5. Secondary Research

2.6. Assumptions

3. Executive Summary

3.1. Global Market Snapshot, by Geography

3.2. Plant Based Protein Market, by Type

3.3. Plant Based Protein Market, by Application

3.4. Competitive Landscape

4. Market Overview

4.1. Market Dynamics

4.1.1. Driving Forces

4.1.1.1. Increasing Vegan Population

4.1.1.2. Growing Health and Wellness Trend

4.1.1.3. Increasing Consumer Focus on Alternative Protein

4.1.1.4. Increasing Demand from Food And Beverage Industry

4.1.2. Restraining Factors

4.1.2.1. Significant Preference For Animal Based Protein

4.1.3. Opportunity Matrix

4.1.3.1. Development of New Sources

4.1.3.2. Developing Economies

5. Industry Insights

5.1. Porter's Five Forces Analysis

5.1.1. Bargaining power of supplier

5.1.2. Bargaining power of buyer

5.1.3. Threat of substitute

5.1.4. Threat of new entrant

5.1.5. Degree of competition

5.2. Value Chain Analysis

5.3. Market Share Analysis

5.4. Pricing Analysis

6. Plant Based Protein Market, by Type

6.1. Soy Protein

6.2. Wheat Protein

6.3. Pea Protein

6.4. Potato Protein

6.5. Corn Protein

6.6. Others

7. Plant Based Protein Market, by Application

7.1. Food and Beverages

7.2. Animal Feed

7.3. Nutrition and Health Supplements

7.4. Pharmaceutical

7.5. Others

8. Plant Based Protein Market, by Region

8.1. North America

8.1.1. U.S.

8.1.2. Canada

8.2. Europe

8.2.1. Germany

8.2.2. France

8.2.3. UK

8.2.4. Italy

8.2.5. Spain

8.2.6. Rest of Europe

8.3. Asia-Pacific

8.3.1. China

8.3.2. Japan

8.3.3. India

8.3.4. Rest of APAC

8.4. Latin America

8.5. Middle East and Africa

9. Competitive Landscape

9.1. Key Players Analysis

9.2. Strategic Analysis

9.2.1. New Product Developments

9.2.2. Mergers & Acquisitions

9.2.3. Portfolio/Production Capacity Expansions

9.2.4. Geographic Expansions

9.2.5. Joint Ventures, Collaborations, Partnerships & Agreements

9.2.6. Others

10. Company Profiles

10.1. Cargill, Incorporated

10.1.1. Company Overview

10.1.2. Financial Snapshot

10.1.3. Products

10.1.4. Recent Developments

10.2. Archer Daniels Midland Company

10.2.1. Company Overview

10.2.2. Financial Snapshot

10.2.3. Products

10.2.4. Recent Developments

10.3. Ingredion Incorporated

10.3.1. Company Overview

10.3.2. Financial Snapshot

10.3.3. Products

10.3.4. Recent Developments

10.4. Roquette Frères Le Romain

10.4.1. Company Overview

10.4.2. Financial Snapshot

10.4.3. Products

10.4.4. Recent Developments

10.5. Kerry Group

10.5.1. Company Overview

10.5.2. Financial Snapshot

10.5.3. Products

10.5.4. Recent Developments

10.6. E.I. Dupont De Nemours And Company

10.6.1. Company Overview

10.6.2. Financial Snapshot

10.6.3. Products

10.6.4. Recent Developments

10.7. Tate & Lyle Plc

10.7.1. Company Overview

10.7.2. Financial Snapshot

10.7.3. Products

10.7.4. Recent Developments

10.8. Axiom Foods

10.8.1. Company Overview

10.8.2. Financial Snapshot

10.8.3. Products

10.8.4. Recent Developments

10.9. Glanbia Plc

10.9.1. Company Overview

10.9.2. Financial Snapshot

10.9.3. Products

10.9.4. Recent Developments

10.10. Beneo GmbH

10.10.1. Company Overview

10.10.2. Financial Snapshot

10.10.3. Products

10.10.4. Recent Developments

LIST OF TABLES

Table 1 Plant Based Protein Market Size, By Type

Table 2 Plant Based Protein Market Size, By Application (US$ Mn, CAGR %), 2019-2025

Table 3 Plant Based Protein Market, By Region, (US$ Mn, CAGR %), 2019-2025

Table 4 North America: Plant Based Protein Market Size, By Country, (US$ Mn, CAGR %), 2019-2025

Table 5 North America: Plant Based Protein Market Size, By Type (US$ Mn, CAGR %), 2019-2025

Table 6 North America: Plant Based Protein Market Size, By Application (US$ Mn, CAGR %), 2019-2025

Table 7 US: Plant Based Protein Market Size, By Type (US$ Mn, CAGR %), 2019-2025

Table 8 US: Plant Based Protein Market Size, By Application (US$ Mn, CAGR %), 2019-2025

Table 9 Canada: Plant Based Protein Market Size, By Type (US$ Mn, CAGR %), 2019-2025

Table 10 Canada: Plant Based Protein Market Size, By Application (US$ Mn, CAGR %), 2019-2025

Table 11 Europe: Plant Based Protein Market Size, By Country (US$ Mn, CAGR %), 2019-2025

Table 12 Europe: Plant Based Protein Market Size, By Type (US$ Mn, CAGR %), 2019-2025

Table 13 Europe: Plant Based Protein Market Size, By Application (US$ Mn, CAGR %), 2019-2025

Table 14 Germany: Plant Based Protein Market Size, By Type, (US$ Mn, CAGR %), 2019-2025

Table 15 Germany: Plant Based Protein Market Size, By Application (US$ Mn, CAGR %), 2019-2025

Table 16 France: Plant Based Protein Market Size, By Type, (US$ Mn, CAGR %), 2019-2025

Table 17 France: Plant Based Protein Market Size, By Application (US$ Mn, CAGR %), 2019-2025

Table 18 UK: Plant Based Protein Market Size, By Type, (US$ Mn, CAGR %), 2019-2025

Table 19 UK: Plant Based Protein Market Size, By Application (US$ Mn, CAGR %), 2019-2025

Table 20 Italy: Plant Based Protein Market Size, By Type, (US$ Mn, CAGR %), 2019-2025

Table 21 Italy: Plant Based Protein Market Size, By Application (US$ Mn, CAGR %), 2019-2025

Table 22 Spain: Plant Based Protein Market Size, By Type, (US$ Mn, CAGR %), 2019-2025

Table 23 Spain: Plant Based Protein Market Size, By Application (US$ Mn, CAGR %), 2019-2025

Table 24 Rest of Europe: Plant Based Protein Market Size, By Type, (US$ Mn, CAGR %), 2019-2025

Table 25 Rest of Europe: Plant Based Protein Market Size, By Application (US$ Mn, CAGR %), 2019-2025

Table 26 Asia-Pacific: Plant Based Protein Market Size, By Country, 2019-2025 (Kiloton)

Table 27 Asia-Pacific: Plant Based Protein Market Size, By Type, (US$ Mn, CAGR %), 2019-2025

Table 28 Asia-Pacific: Plant Based Protein Market Size, By Application (US$ Mn, CAGR %), 2019-2025

Table 29 China: Plant Based Protein Market Size, By Type, (US$ Mn, CAGR %), 2019-2025

Table 30 China: Plant Based Protein Market Size, By Application (US$ Mn, CAGR %), 2019-2025

Table 31 Japan: Plant Based Protein Market Size, By Type, (US$ Mn, CAGR %), 2019-2025

Table 32 Japan: Plant Based Protein Market Size, By Application (US$ Mn, CAGR %), 2019-2025

Table 33 India: Plant Based Protein Market Size, By Type, (US$ Mn, CAGR %), 2019-2025

Table 34 India: Plant Based Protein Market Size, By Application (US$ Mn, CAGR %), 2019-2025

Table 35 Rest of APAC: Plant Based Protein Market Size, By Type, (US$ Mn, CAGR %), 2019-2025

Table 51 Rest of APAC: Plant Based Protein Market Size, By Application (US$ Mn, CAGR %), 2019-2025

Table 53 Latin America: Plant Based Protein Market Size, By Type, (US$ Mn, CAGR %), 2019-2025

Table 54 Latin America: Plant Based Protein Market Size, By Application (US$ Mn, CAGR %), 2019-2025

Table 56 Middle East and Africa: Plant Based Protein Market Size, By Type, (US$ Mn, CAGR %), 2019-2025

Table 57 Middle East and Africa: Plant Based Protein Market Size, By Application (US$ Mn, CAGR %), 2019-2025

LIST OF FIGURES

Figure 1 Plant Based Protein Market Segmentation

Figure 2 Plant Based Protein Market: Research Design

Figure 3 Drivers, Restraints, and Opportunities in the Plant Based Protein Market

Figure 4 Plant Based Protein Market: Porter’s Five Forces Analysis

Figure 5 Plant Based Protein Market: Value Chain Analysis

Figure 6 Plant Based Protein Market: Market Share Analysis

Figure 7 Plant Based Protein Market: Pricing Analysis

Figure 8 Plant Based Protein Market, By Type (2019-2025)

Figure 9 Plant Based Protein Market, By Application (2019-2025)

Figure 10 Global Plant Based Protein Market, By Region

Figure 11 North America: Plant Based Protein Market Snapshot

Figure 12 Europe: Plant Based Protein Market Snapshot

Figure 13 Asia-Pacific: Plant Based Protein Market Snapshot

Figure 14 Latin America: Plant Based Protein Market Snapshot

Figure 15 Middle East and Africa: Plant Based Protein Market Snapshot

Figure 16 Cargill, Incorporated: Financial Snapshot

Figure 17 Archer Daniels Midland Company: Financial Snapshot

Figure 18 Ingredion Incorporated: Financial Snapshot

Figure 19 Roquette Frères Le Romain: Financial Snapshot

Figure 20 Kerry Group: Plant Based Protein Market Snapshot

Figure 21 E.I. Dupont De Nemours And Company: Financial Snapshot

Figure 22 Tate & Lyle Plc: Financial Snapshot

Figure 23 Axiom Foods: Financial Snapshot

Figure 24 Glanbia Plc: Financial Snapshot

Figure 25 Beneo GmbH: Financial Snapshot

Let us know more about your research need and we will customize an offer exclusively for you!

Let us know more about your research need and we will customize an offer exclusively for you!

Testimonial

© 2019 Data N Analysis. All Rights Reserved | Design by Data N Analysis